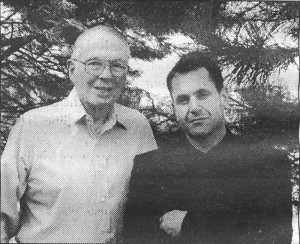

At the time of the Simtek IPO in 1991, Dr. Petritz believed Simtek was on more solid footing and could rely on the management team to execute business operations. He teamed up with Jeff Cooper in 1992 to pursue new investments and support Simtek’s growth as needed. New Venture Resources (NVR) based its operations on the New Business Resources (NBR) model (of the 70s) and the style of private investing Petritz had developed over his 38 years of managing new technologies and new companies.

Operating as “Super Angels” – a professional venture capital operation based on investing family money – NVR worked in support of private placements and “venture management” agreements with emerging companies. NVR’s methods of private investing incorporated a modification of planning techniques first developed at Texas Instruments known as the OST system (Objectives, Strategies, Tactics).

As Petritz and Cooper applied it to venture investing it relied on (i) recruiting or backing an outstanding man to fill the position of President and general manager (for each portfolio company), (ii) serving as interim executives on incomplete management teams, then (iii) placing an NVR partner on the board to assist in establishing long range objectives, medium term strategies, and short term (tactical) plans and then reviewing progress in accomplishing these plans 1)A process described in detail in the New Venture Resources, Ltd. Private Placement Memorandum, August 31, 1977. . As practiced at NVR – and first enumerated in the prospectus of NBR (1968) — the resources of NVR were used for:

- Financial planning and venture finance

- Business planning

- Venture management by seasoned executives and venture partners

- Selection and development of professional people

- New technologies developed at university graduate research laboratories, sponsored by the U.S. government.

Best Practices

Early-stage private investment in new technology is fraught with a multitude of risks. As a venture task, differentiating research from development is a necessary function. As a best practice of Angel and Seed investing the approach is not to immediately criticize the “foolish” entrepreneur or new technologies, but rather to ask, what work must be done to develop this idea or concept into a more fundable approach to solving customer problems. That requires a degree of patience and rapport between entrepreneur and investor. These combined elements formed the basis for NVR , as a time-tested approach to early-stage investments. Though successful Angels may not always be heavenly, they are rarely Sharks (except on Television dramas)!

Capital Formation and Entrepreneurial Ecosystems

During the 90s NVR was responsible for private placements in support of tech-based start-ups, corporate development engagements and creating entrepreneurial infrastructure and capital formation activities along the Colorado Front Range. That included Cooper’s work co-founding angel networks (CCA and HAI) and business incubators in Colorado (CSTI):

- The Colorado Capital Alliance, Inc (CCA), — founded in August 1995 by Jeff Cooper, Jerry Donahue, Mike Gabridge and Bob Keeley — was Colorado’s first statewide Angel Network and winner of the US SBA’s 1999 Model of Excellence Award in the Venture Capital category. It’s intellectual property and operations were acquired by the Ewing Kauffman Foundation in 1998.

- High Altitude Investors (HAI) was an Angel organization located in Colorado Springs, co-founded by Chris Blees, Jeff Cooper and Chris Odell in 2008.

- The Colorado Springs Technology Incubator (CSTI) was co-founded 1999 by Cooper, Robert Keeley (a retired venture capitalist and University of Colorado professor) , Al Steiner (retired Hewlett Packard GM) and others to serve the needs of technology-based emerging start-ups in Southern Colorado.

Following Dr. Petritz’s retirement Cooper took lead as Managing Director of New Venture Resources, LLC in 1999. Combined, NBR and NVR executed multiple rounds of investment in 23 different private companies. Venture firm makes it’s mark (PDF)

References

| ↑1 | A process described in detail in the New Venture Resources, Ltd. Private Placement Memorandum, August 31, 1977. |

|---|