While at TI, Dr. Petritz honed his acumen for spotting both technological and business opportunities in the field of semiconductors. In his Oral Interview with IEEE, Petritz observes

“(Start-up) Fairchild Semiconductors brought out a silicon planar transistor that was just head and shoulders above anything that anybody else had. And I realized quite early that these were the competitors, it wasn’t the big companies. It also showed me personally that it didn’t really take a lot of people or a lot of money to start a company in the semiconductor business. And I realized that my job at Texas Instruments was primarily one of starting new businesses for T.I., and we were quite successful at that.” 1)“Richard Petritz: Oral Interview”, Center for the History of Electrical Engineering /IEEE History Center, June 21, 1996.

With that realization Dick decided to venture out on his own to start new businesses around emerging technologies in microelectronics. In 1968 he and TI colleague Richard Hanschen formed New Business Resources (“NBR”). At that time the SBIC program had been in existence for only a decade.2) A congressional act permitted the US SBA to develop and license the Small Business Investment Company in 1958.

There had historically been a very small handful of wealthy families and Family Offices in the Northeast US that were investing in risky new business projects. Pioneers of West Coast venture capital (such as Bill Draper and Pitch Johnson) were in very short supply.

NBR was one of the first venture capital companies in the Rocky Mountain – Southwest organized as a venture capital partnership, concentrating its activity exclusively on early-stage, high-technology start-ups. Its playbook was developed by Dr. Petritz’s own style of management and through refinement of best practices he and partner Hanschen had acquired working for Texas Instruments.

With a wealth of experience managing engineers and moving R&D into production and sales, NBR provided the “hands on” touch that technically-driven new companies required. It was this value added approach to launching new companies that NBR was pioneering in electronics and information age start-ups. In an interview with Business Week magazine in 1969, NBR coined the phrase “venture management” to describe an aspect of their approach to venture investing.. Business Week Reprint 11/01/69 (PDF)

ACTIVE INVESTMENT AND VENTURE MANAGEMENT

Dr. Petritz realized the impacts that new innovations in microprocessors and manufacturing technology (e.g. ion implantation) would have on both computers and semiconductor fabrication and incorporated those insights into several portfolio companies, two of which Petritz served as a company President:

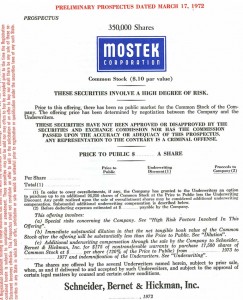

Mostek Corporation

Co-founded by L. J. Sevin, Louay E. Sharif and Richard L. Petritz in 1969, primarily developed and sold (DRAM) memory products. Mostek was launched through a partnership with Sprague Electric of Worcester, Mass., followed by execution of a public offering of securities in its early years(IPO in 1973) . Mostek Prospectus (PDF) At its peak Mostek employed 10,000 and was the US’s largest producer of circuits before being sold to United Technologies for $345,000,000 in 1980. Central operations and production were located in Carrollton, Texas. A wafer fab and design center built in Colorado Springs during the late 1970’s employed 400 and those facilities on Garden of the Gods road continued to produce economic returns to Colorado Springs when recycled for use by a long string of microelectronics companies over the next two decades (United Technologies, ST Microelectronics, Rockwell, Intel and Aeroflex).

Linolex Systems

Was founded in 1970 by James Lincoln and Robert Oleksiak with funding from NBR. Linolex Systems was recognized by the Boston Computing Society as the first true commercial personal computer. Linolex based its technology on microprocessors, floppy drives and software. It was a microcomputer system for application in the intelligent terminal and word processing businesses and sold systems through its own sales force. With a base of installed systems in 500 plus customer sites 3)Linolex Systems, Internal Communications & Disclosure in 3M acquisition, The Petritz Collection, 1975., Linolex Systems was sold to 3M in 1975 — a year before Apple Computer, was first incorporated in 1976. Diversity keeps engineers on their toes. (PDF)

“Was founded in 1970 by James Lincoln and Robert Oleksiak with funding from NBR. Linolex Systems was recognized by the Boston Computing Society as the first true commercial personal computer.”

This style of First Round investments and a patient, hands-on approach proved to be paradigmatic to the “new breed” of venture capitalists, a strategy further implemented by Dr. Petritz’s contemporaries, such as:

- Don Valentine (Marketing & Sales, Fairchild Semiconductor) of Sequoia Capital, founded in 1972.

- Eugene Kleiner (Co-founder of Fairchild Semiconductor) of Kleiner, Perkins, founded in 1972; and

- L.J. Sevin (Co-founder of Mostek Corp) and Ben Rosen (Sevin Rosen Funds) founded in 1980.

Reflecting on wisdom acquired in a decade of venture investing, Ben Rosen stated “If there’s anything different now from how we did things nine years ago it’s focusing more heavily on incubating”,… “we think the most added value and the highest reward comes at the pre-start-up level”.4)Mamis, R.A., “Risky Business”, Inc. Magazine, March, 1990

The evolution of Dr. Petritz’s experience as a commercial R&D Manager and then Venture Capitalist would further shape a philosophy and strategy of starting and funding new, tech-based companies to come.

Audio Interview: Driving Innovation

CROSSROADS – VENTURE CAPITALIST AND INDUSTRIALIST (1976-1978)

The NBR Venture Capital Partnership founded seven companies, with leading-edge products including MOS (Metal-oxide-silicone) memory devices, personal computers, thermal print heads, plasma display screens and enterprise software for hospital management. At the end of the seven year partnership life, Petritz began establishing the ground work for another venture capital company (New Venture Resources, LTD) in the summer of 1977. NVR’s investment portfolio would focus on commercialization of emerging technologies in microelectronics and computer software. Its operations would be based in the practices that evolved from Bell Labs to Texas Instruments and further refined at New Business Resources.

ELECTRONICS INDUSTRY VISIONARY

With nearly two decades of experience as an engineering manager, product technology strategist and venture capitalist Dr. Petritz had acquired a deeper perspective on how the broader “Information Age” industries would develop. That perspective was laid out in his Keynote Address at the International Solid State Circuits Conference (ISSCC) in Philadelphia, 1976, nearly ten years after presenting the Keynote Session at the same conference in 1968. ISSCC- Electronic News Article (PDF)

His Session paper “Emerging Role and Impact of the Microprocessor” (PDF) was not only an articulation of how the computer and semiconductor industries would continue to evolve. It was also a milestone comment on an industry vision laid out by Petritz in 67’ and 68’, and even earlier by Patrick Haggerty (President of Texas Instruments). In Haggerty’s 64’ keynote article he articulated a long-term vision of the “pervasiveness of Integrated Electronics” and its role in shaping all aspects of society. Haggerty said this vision of the future would only be obtained because of the chief role that the electronics industry would play in solving the problems of cost, reliability and complexity.5)P.E. Haggerty, “Integrated Electronics – A Perspective, “, Proc. IEEE, vol.52, pp. 1400-5, December 1964. By today’s standards, these perspectives highlight a key differentiation between the role and value creation activities of commercial entities versus Universities and Federal Labs; namely a focus on customer solutions through use of technology, product engineering and market channel development.

ELECTRONICS INDUSTRY CONSULTANT

Holding a broad industry perspective, Petritz joined the board of the Leeds &

Northrup Corporation in 1976 and became a consultant for the World Bank and the Korean Government.

Dick’s role was to formulate the “Korean Fourth Five Year Electronics Industry Development Plan” Read the 5 Year Plan (PDF) , to extend the Korean Electronics industry into high technology products.

Working closely with the World Bank, Korean executives from The Gold Star Co. and Nam Duck Woo, (Korea’s Deputy Prime Minister and Minister of Economic Planning Board), the published plan became a blueprint for Korean industrial development into large scale microelectronics research, a new silicon wafer Fabrication Program, and a product roadmap for electronics components (e.g. Chips for LEDs, LCDs, watches, & calculators).

During the mid-70s the Korean electronics industry was largely focused on lower-tech assembly of chips and electrical sub-assemblies. Gold Star, (later to be known as LG Electronics) and the Korean government saw the need to get into actual semiconductor production, for initial introduction into Korean electronic goods. Where Dr. Petritz provided perspective on the industrial requirements, technology analysis and product roadmap, his colleague Glen Madland of I.C.E. focused on operational planning for production and workforce training.

The prescription for developing the Korean Microelectronics industry boiled down to:

- Defining major responsibilities of the labs (e.g. e-beam and X-ray imaging, ceramics materials innovation, oxide growth and removal techniques, Improved crystal evaluation techniques, process of large-diameter slices)

- Developing domestic expertise in advanced manufacturing equipment

- Implementing training programs to provide people with the special skills the industry would require

- Helping firms establish the relevance of microelectronics to their business

- Improving the rate of application of microelectronics in industry

- Raising national awareness of potential of microelectronics in industry

As a direct result of Petritz and Madland’s activities, the World Bank provided a $30,000,000 grant to establish a Korean semiconductor research center. This then preceded aggressive product and industry development for what are today Korea’s largest semiconductor and electronics companies. 6)“Richard Petritz: Oral Interview”, Center for the History of Electrical Engineering /IEEE History Center, June 21, 1996.

Government Investment and Industry Development

The “brass ring” for government support of a semiconductor industry was not specifically for chip manufacturing alone. Rather, it was to support the entire value chain that comes with having semiconductor R&D and fabrication in close proximity with the rest of the electronics industry. With ever-increasing microelectronics integration, power, and reduced price, staying on the leading edge of the development curve also meant that computer makers and consumer electronics companies could package advanced chips into new products. Leading in cost and performance, those products would enjoy a competitive Value Advantage in the global market. The economic multipliers for countries capable of competing in the electronics market place were high. And the Koreans were not the only Country in the mid-seventies needing to “catch-up” in the world of advanced electronics.

References

| ↑1 | “Richard Petritz: Oral Interview”, Center for the History of Electrical Engineering /IEEE History Center, June 21, 1996. |

|---|---|

| ↑2 | A congressional act permitted the US SBA to develop and license the Small Business Investment Company in 1958. |

| ↑3 | Linolex Systems, Internal Communications & Disclosure in 3M acquisition, The Petritz Collection, 1975. |

| ↑4 | Mamis, R.A., “Risky Business”, Inc. Magazine, March, 1990 |

| ↑5 | P.E. Haggerty, “Integrated Electronics – A Perspective, “, Proc. IEEE, vol.52, pp. 1400-5, December 1964. |

| ↑6 | “Richard Petritz: Oral Interview”, Center for the History of Electrical Engineering /IEEE History Center, June 21, 1996. |