While laying foundations for New Venture Resources, Ltd in 1977 ( “NVR” a venture capital fund), Dr. Petritz began working on a business plan to found another start-up semiconductor company. NBR and its involvement with Mostek Corp had proven to be a successful strategy. Dr. Petritz began circulating a prospectus for NVR on Wall Street in the summer of 77’ while developing a framework for a new semiconductor company.

Weighing the role of a venture capitalist he concluded his greatest value and interest was in starting new companies around new technologies. Like a VC he would act at a high level through board oversight, and as a company founder would perform the most necessary functions of establishing a company vision, raising capital and recruiting the best talent he could find. INMOS evolved from this underlying strategy.

FROM EMOS TO INMOS

In the Fall of 1977 Petritz had written a business plan for another semiconductor start-up company (“Kmos”) and had begun discussions with Dr. Paul Schroeder, already a veteran semiconductor design engineer. The plan for Kmos had actually sprung from an earlier business plan & prospectus first drafted by Petritz March 23 1976, as EMOS Incorporated. The technology strategy of EMOS focused on:

“memory circuits and designs of a microcomputer product on a single chip … with the optimal choice of process technology as MOS, and initially stressing advanced NMOS with silicon-gate ion implantation and other process innovations”.1)EMOS INCORPORATED, Business Plan & Prospectus, Richard L. Petritz, March 23, 1976; private papers, The Petritz Collection.

Kmos business strategy incorporated insights from the Petritz 76’ study presented in paper form at the ISSCC and from the consulting analysis work he had done with the South Koreans and IBM in 76’ and 77’.

By October 1977 a full business plan for Kmos was written, with input from British computer scientist Iann Barron. The plan emphasized MOS memory products with development of microprocessor technology. It envisioned production in both the US and the UK.

In less than two years, what began as a plan for the Kmos Corporation was subsequently funded through Petritz seed capital and an approximate $100,000,000 investment commitment from the British government. Petritz’s initial purchase of 60,000 shares of Flatprode, Ltd in the UK on April 11, 1978 was subsequently converted on a 5:1 stock split when Flatprode Ltd became Inmos International plc. Together with co-founders Iann Barron and Paul Schroeder, INMOS International plc — and two Operating Subsidiaries; Inmos Limited (UK) and Inmos Corporation (US) — was launched.

Left to Right: Front Row – Dr. John Sawkill, Sir William Barlow, Dr. Richard Petritz, Mr Peter Moody, Mr Martin Harris

Back Row – Dr Paul Schroeder, Mr Richard Hall, Mr Iaan Barron – Inmos Board of Directors, 1980

INMOS GENESIS

In 1977 Professor Iann Barron was organizing a session on the future of computers at the IFIP conference in Toronto and asked Dr. Petritz to present on semiconductors . After the panel presentation and casually over drinks they discussed the notion of starting a new semiconductor company and history was made.

In October 1977 the two of them approached the National Enterprise Board (“NEB”) of the British Government with the concept of forming a new semiconductor company. An agreement was struck with NEB in March 1978 and British Cabinet approval was obtained in July 1978.

Soon after the third co-founder of INMOS, Paul Schroeder (previously a lead memory designer for Mostek Corp), became active in executive management of INMOS as Chief Operating Officer and a rapid recruitment effort of the operating management team ensued.

The majority of the management and technical team leads on the American side came with experience from Bell Labs, Sandia and Texas Instruments. First sales on the 16K static RAM were made in December 1980. A month later construction began on the production facility in Newport, South Wales. The official opening of the “award winning micro chip plant at Duffryn, Newport” occurred on February 25, 1983.

Speaking at the Newport Plant opening ceremonies were Richard Petritz, his Royal Highness Prince Charles, and Malcolm Wilcox, Chairman of the Inmos International PLC Board and a member of the British Technology Group. 2)“Prince to open Inmos factory”, South Wales Argus, January 26, 1983.

Mr. Wilcox stated “We would all acknowledge that Britain must remain in the forefront of technological progress and what you have seen this morning is the beginning of a development that will, we hope, achieve two objectives: First, it will constitute the commercial application of the most advanced design skills to be found in the semiconductor industry; and second, it will represent the establishment of a new work centre, which will provide fresh employment opportunities”.

With this financial commitment from the Labour Government the UK microelectronics industry was born. 3)“Tech Clusters: How the West was won”, The Economist, Aug, 2011. With it came an uneasy partnership with the highest levels of British government, as it was largely British tax payors dollars directly invested into the stock of a single company, with the intent of UK economic and industrial development.

Timothy Ramsey, John Heightley, Richard Petritz and Princess Anne; on tour of Inmos Corp – Colorado Springs

INMOS : Innovation, Production, & Culture (1978-1984)

Dr. Petritz summarized the founding philosophy of INMOS this way 4)Petritz, RL, “World Electronics and INMOS”, Company Report & Presentation, December 4, 1981:

“Each new generation of technology gives rise to new companies. There is always a best company in each area. Back in the days of the planar transistor, the best discrete device company was Fairchild. Then Texas Instruments came a long and was the best in the bipolar integrated circuit days. In the 1970’s, the large scale integration era, Intel was unquestionably the best company. With the new very large scale integration (VLSI) era, I believe there is an opportunity for another best company to emerge and it is INMOS goal to be that company”.

The company name – “INMOS” — represented both the International founding of the company as well as the basis for VLSI components: n-channel MOS, or NMOS technology. Thus, it became known as International MOS or INMOS. A product strategy was established to include memory components and a microprocessing system built on parallel processing technology (the Transputer), a first of its kind.

Petritz and INMOS co-founder Paul Schroeder represented both a product orientation and new manufacturing approaches as speakers at the February, 1979 International Solid State Circuits Conference

Work in Colorado Springs concentrated on memory products and process technologies (e.g. CMOS processes and device physics) and R&D in Bristol on microprocessors and VLSI design techniques. To accomplish these ambitious goals Dick knew he would rely on what he referred to as “Industry Superstars”.

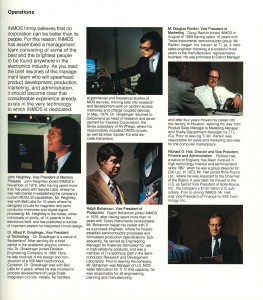

MANAGEMENT TEAM

At the time INMOS was started there were a limited number of device and process engineers in the World to choose from. Dick compared them analogically to Athlete Superstars. As in professional sports, there are a limited number of all-stars in play. Success in scouting and recruiting them is a necessity for winning seasons. Once on the team, creating the right (corporate) culture and organization is an imperative for fostering teamwork and entrepreneurial drive.

Over the course of his career – (scientist, commercial lab director, venture capitalist and start-up executive) — Dick had developed principles of innovation he believed critical for creating entrepreneurial companies. Hiring young, smart talent with a drive to achieve, setting worthy goals to shoot for, and spreading the ownership of the company to the employee base (through stock options and achievement recognition) were all part of the plan. But critical for innovation was Dick’s belief in a positive but competitive R&D culture. It was these elements of corporate practice — Dick first acquired at Texas Instruments – that became the recipe for creating the right environment for innovation.

The (relatively young) INMOS management team with John Heightley from Sandia and Bell Labs (ultimately serving as President) proved to be exemplary of this approach. Analogically, Petritz saw his role as both a “Team” Manager and owner. Having established a vision for the company and a plan of financial support with his co-founders, Dick’s focus then turned to the most important job: developing the management team and creating a system and corporate culture to support recruitment, retainment and productivity of personnel.

The success of this management style was exemplified on April 23, 1981 when it was announced that INMOS had received the prestigious Tobie Award for the development of the IMS 1400 (16K Static RAM) at a banquet of the Electronics Components Industry Federation, held at the Guild Hall in London. The award was for the best research and development accomplishment during the year by a UK company, voted for by the readers of Electronic Times, the leading British electronics newspaper.

The success of this management style was exemplified on April 23, 1981 when it was announced that INMOS had received the prestigious Tobie Award for the development of the IMS 1400 (16K Static RAM) at a banquet of the Electronics Components Industry Federation, held at the Guild Hall in London. The award was for the best research and development accomplishment during the year by a UK company, voted for by the readers of Electronic Times, the leading British electronics newspaper.

Accepting the award on behalf of INMOS, Dick said “INMOS was founded on the idea that it must innovate and not just copy the products of its competitors and the belief in the importance of superstar’s in the semiconductor industry.” 5)INMOS Memorandum and Press Release, the Petritz Collection, April 24, 1981.

Inmos Mgt and IMS 1400 Design Team, left to right: Sud, Iann Barron, Rahul Sud, Kim Hardee, Dick Petritz, ?, Jim Adams

CORPORATE LOCATIONS

Location of the company was also a strategic asset for recruitment. It was a lesson learned early, as formation of Mostek Corp in 1969 was in part catalyzed by Texas Instruments decision to re-locate engineering talent from Dallas to Houston. The proposed relocation proved to be an unpopular decision amongst some of TI’s engineers, who sought another alternative to moving. In the case of Mostek, Carrollton TX — a city in Dallas County– provided a nice home for the newly formed company and its (ex-TI) employees.

In 1979 Silicon Valley companies were aggressively competing for engineers and company loyalty was not high. Petritz and Schroeder took stock of these facts and reasoned placing companies in attractive areas to work and play that were relatively close to breeding grounds for trained engineers would bring people with a pioneering spirit and a desire to stay once they moved. Site selection included factors such as ease of transportation, water, power, low-cost land and tax incentives.

Colorado Springs, Colorado was then chosen as the U.S. headquarters for INMOS. As Dick himself put it, “location was a big part of the plan for enticing (Superstar) highly-paid researchers from California, Texas and the East where semiconductor research was centered to move.” 6)Potter, R., “Cast of ‘Superstars’ Assembled: Inmos Conducting New Electronics Race”, Gazette Telegraph, (E) July 1, 1979.

Said Petritz,

“we wanted a location with great natural beauty, a refreshing climate and the opportunity for cultural stimulation”. 7)Wyman, S., “Computer Products Firm Will Employ 1,000 Here”, Gazette Telegraph, January 26, 1979.

It proved to be a winning strategy in the UK as well, where Bristol, England was established as the INMOS design center and a new wafer fab was constructed in Newport, South Wales.

CORPORATE APEX

By 1984 INMOS management had built a multinational corporation with 2,400 employees spread between the US and the UK, two state of the art production facilities (85,000sqft in Newport with another 90,000 sqft under construction and 135,000 sqft in Colorado Springs), approximately $144,000,000 in revenues (primarily from the sale of 16K static and 64K dynamic RAMs) and a valuable patent portfolio. But continued investment was required.

Following a deep recession in the US from 1980 – 1982, economic pressure from the “worst semiconductor slump in history” was quickly evolving in 1984 and was full on by 1985, largely due to continued economic weakness in the US, and semiconductor chip dumping by the Japanese. The leading edge of the semiconductor crisis was the DRAM market, where global sales dropped 61% from 1984 to 1985 and the average retail price of a 64K DRAM dropped from $3 – $4 apiece to as low as 30 cents. 8)Dohlman, PA, “The US-Japan semiconductor trade arrangement: political economy, game theory & welfare analysis”, Duke University, 1993.

INMOS: ACQUISTION AND RESTRUCTURING

Financial pressures and the headwinds of political change in the UK – the majority of INMOS stock being owned by the British Government, held by the British Technology Group (“BTG”) – led to the sale of INMOS to Thorn EMI in 1984 for approximately $145,000,000 dollars. By Thorn EMI’s account, when all obligations were paid they had acquired all of INMOS International Ltd for $230 million. 9)Fallon, J., “Thorn EMI Completes Inmos Sale to SGS-Thomson”, Electronic News, March 20, 1989.

Expressed interest from non-UK bidders (e.g. AT&T and RCA) was spurned by the INMOS board of directors in favor of a strong UK-centric company. From the British Government perspective, foreign control of INMOS would have been “extraordinary folly” and “foolhardy and grossly irresponsible”, fearing that acceptance of the AT&T bid would kill the UK’s hold on a key industrial component (general-purpose microchips), its investment in novel microprocessor technology, and most of the employment created by the UK’s investment in INMOS. 10)“SDP bombshell on Inmos Sale”, Western Daily Press, June 21, 1984

11) Large, P., “IT industry in grave danger, says Neddy”, The Guardian, June 21, 1984

Though Petritz and the INMOS executive team were bullish on INMOS prospects 12)Heilman, W., “Inmos profitable now, despite 1983 losses”, Gazette Telegraph, May 10, 1984

, The British Technology Group was under mounting pressure to “dispose of all of its holdings to private companies as soon as it was commercially feasible”, said John Butcher, Undersecretary of State for information technology 13)Large, P., “IT industry in grave danger, says Neddy”, The Guardian, June 21, 1984. This mandate pressed the INMOS board of directors to favor a liquidity event for shareholders where a large number (as in, all) of BTG-held shares could be disposed of. The board directive to create a timely exit for BTG shares — with a strong preference for a UK corporate acquirer — did not leave many options.

Plans for an IPO of INMOS stock developed in early 1984 were dashed in early 1985. A lead underwriter had been chosen (Merrill Lynch) and a Form F-1 Registration Statement written, but all further activities were abandoned within the first quarter of 1985, subsequent to the remaining shares of stock being acquired by Thorn EMI. The management agreement between INMOS and Petritz’s Venture Management company – first dated August 12, 1978 – was renegotiated July 17, 1984 and subsequently terminated by Thorn EMI in July 1985. 14)Thorn EMI Acquisition documentation for the INMOS board of directors, Company Internal Documents, The Petritz Collection.

TIMELINE OF INMOS – SELECTED DATES FROM BIRTH TO ACQUISITION 15)Richard L. Petritz, “World Electronics and INMOS”, Dec 4, 1981; Company Internal Documents, The Petritz Collection.

Shortly after the acquisition, a board shake-up and CEO change at Thorn EMI in July, 1985 resulted in appointment of a new CEO. 16)Fallon, J, “Thorn Ousts CEO, Most of Inmos Mgmt.”, Electronic News, July 8, 1985.

A strategy shift to cut costs and unprofitable divisions that weren’t core to Thorn EMI’s historic lines of business was implemented.

In 1987 French electronics conglomerate Thomson S.A. acquired the consumer-electronics unit of Thorn EMI. INMOS (and its patent portfolio) was sold to SGS-Thomson in 1989. STMicroelectronics was formed in 1987 by the merger of semiconductor companies SGS Microelettronica (Società Generale Semiconduttori) of Italy and Thomson Semiconducteurs, the semiconductor arm of France’s Thomson. At the time of the merger the company was known as SGS-THOMSON but took its current name in May 1998 following the withdrawal of Thomson SA as an owner.

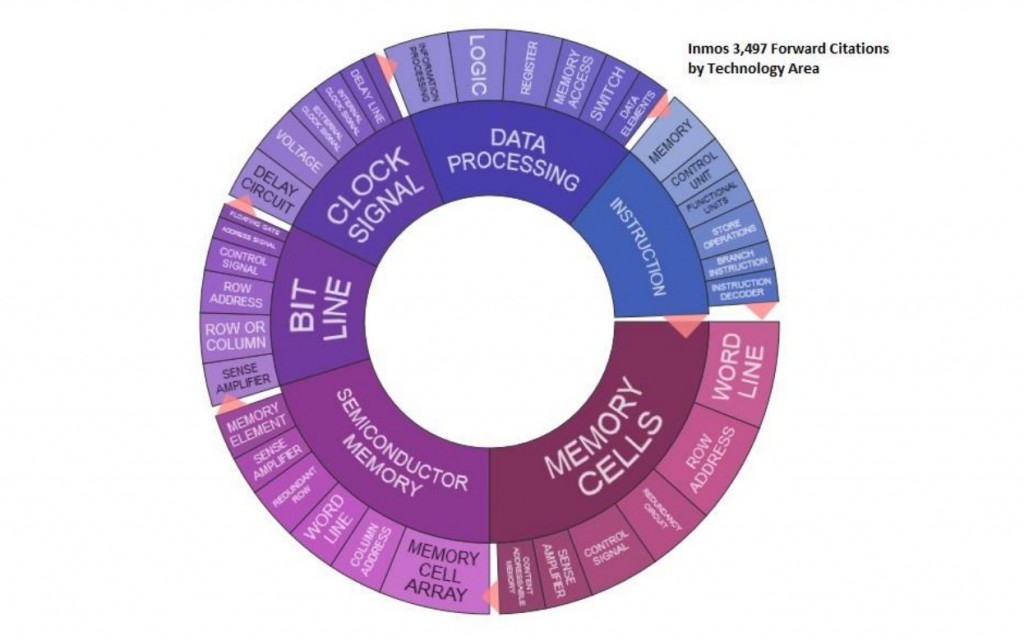

Having previously acquired Mostek Corp. from United Technologies Corporation in 1985, SGS – Thomson (STMicroelectronics) had consolidated the operations and intellectual property of two companies co-founded by Dr. Petritz.

INMOS & ENTREPRENEURIAL ECOSYSTEMS

Though INMOS ceased to continue as a going concern, its success as an entrepreneurial venture can be measured by both its economic returns and industry impact. Investors and employees collectively made millions. Manufacturing facilities were re-purposed and used many times over to support company attraction and job development, in Colorado Springs and South Wales. An industry-shaping portfolio of patents yielded high ROI for Thorn EMI and STMicroelectronics, and became prior art for thousands of subsequent patents The In in Inmos Stands for Innovation (PDF).

Young management received experience and was recycled within Colorado Springs and Bristol to become executives in other High-Tech companies. An Entrepreneurship Ecosystem was formed in Colorado Springs and Bristol that yielded several generations of spin-out firms, additional investment capital and entrepreneurial infrastructure. The multiplier effects were felt not only in economic development but also in community, art and culture(Add Spin-out Family Tree Link Here).

ART, CULTURE AND ENTREPRENEURSHIP

Many of the employees of INMOS were attracted to Colorado Springs natural beauty and were musicians and supporters of performing arts in Colorado Springs, attending concerts and hiring Colorado Springs Symphony members as music instructors for their children. Dr. Petritz himself was a lover of performing arts (reportedly seeing the English version of Andrew Lloyd Weber’s “Cats” 34 times), served as a board member for the Colorado Springs Symphony from 1992 to 1998, and continued charitable contributions to many local arts groups until his death.

Dr. Petritz’s co-founder in Simtek Corporation and an alumni of INMOS, Dr. Gary Derbenwick, played violin for the Colorado Springs Symphony and the Philharmonic for two decades. Both he and Petritz served as active fundraisers for the Symphony and the Philharmonic.

For Dr. Petritz it was not merely love of the arts that drove him. He realized at the start of INMOS that for Colorado Springs to grow into a great city, capable of recruiting the kinds of engineering and creative talent necessary to support emerging business growth, support for arts and culture was a MUST DO activity. Dick opined on many occasions, a City isn’t a truly progressive City without cultural anchors like a Symphony and robust arts scene.

References

| ↑1 | EMOS INCORPORATED, Business Plan & Prospectus, Richard L. Petritz, March 23, 1976; private papers, The Petritz Collection. |

|---|---|

| ↑2 | “Prince to open Inmos factory”, South Wales Argus, January 26, 1983. |

| ↑3 | “Tech Clusters: How the West was won”, The Economist, Aug, 2011. |

| ↑4 | Petritz, RL, “World Electronics and INMOS”, Company Report & Presentation, December 4, 1981 |

| ↑5 | INMOS Memorandum and Press Release, the Petritz Collection, April 24, 1981. |

| ↑6 | Potter, R., “Cast of ‘Superstars’ Assembled: Inmos Conducting New Electronics Race”, Gazette Telegraph, (E) July 1, 1979. |

| ↑7 | Wyman, S., “Computer Products Firm Will Employ 1,000 Here”, Gazette Telegraph, January 26, 1979. |

| ↑8 | Dohlman, PA, “The US-Japan semiconductor trade arrangement: political economy, game theory & welfare analysis”, Duke University, 1993. |

| ↑9 | Fallon, J., “Thorn EMI Completes Inmos Sale to SGS-Thomson”, Electronic News, March 20, 1989. |

| ↑10 | “SDP bombshell on Inmos Sale”, Western Daily Press, June 21, 1984 |

| ↑11 | Large, P., “IT industry in grave danger, says Neddy”, The Guardian, June 21, 1984 |

| ↑12 | Heilman, W., “Inmos profitable now, despite 1983 losses”, Gazette Telegraph, May 10, 1984 |

| ↑13 | Large, P., “IT industry in grave danger, says Neddy”, The Guardian, June 21, 1984 |

| ↑14 | Thorn EMI Acquisition documentation for the INMOS board of directors, Company Internal Documents, The Petritz Collection. |

| ↑15 | Richard L. Petritz, “World Electronics and INMOS”, Dec 4, 1981; Company Internal Documents, The Petritz Collection. |

| ↑16 | Fallon, J, “Thorn Ousts CEO, Most of Inmos Mgmt.”, Electronic News, July 8, 1985. |